Manufacturers and Suppliers 2022 Outlook

“Turnstiles are spinning, and a ‘rolling recovery’ for destinations has begun,” declares Guy Nelson, CEO of Dynamic Attractions.

The past 18 months have been challenging for the ridemaker, but like many attractions industry manufacturers and suppliers, Dynamic Attractions has used the time to refocus. Nelson has no doubts that the entire industry will “thrive again” soon.

Just how soon, though, is a matter of debate. Some attractions are enjoying the benefits of pent-up consumer demand, while others are affected by border closures and must still adhere to attendance restrictions.

“We see stops, starts, pauses, and restarts,” Nelson explains. “That is why the reopening of parks does not transfer into an instant demand for new product. Suppliers need to be patient.”

“We expect the attractions industry to make a full, joyful recovery by summer 2022,” adds Michael Needham, president and CEO of SimEx-Iwerks Entertainment. “So, only nine months of sub-par trading to go.”

SimEx-Iwerks’ offices are still not fully open, but that doesn’t mean the last year has been quiet for the flying theater and special effects cinematic company. Far from it. SimEx-Iwerks has launched new attractions in Wisconsin and Missouri and produced several new films, including a sequel for its popular Dino Island attractions called “Frostbite – Dino Island III,” due out next year.

Supply Chains

Supply chain bottlenecks due to work stoppages, port closures, and spikes in demand are impacting companies across the globe, and the attractions industry is no exception.

“Items like shipping containers are commonly delayed in Asia,” adds Ray Smegal, ProSlide Technology Inc.’s chief commercial officer. “It creates some logistical challenges to get them on their way. We’ve had to extend our planning process to compensate for that obstacle.”

Vendors are finding that travel restrictions not only impact consumer demand, but they also hinder the delivery of new products.

“Generally speaking, suppliers have the materials we need, and we have the rides that the parks need.” Nelson explains. “However, getting them and the installers in place is the challenge. For example, right now it takes 15 weeks to get someone from the U.S. to Malaysia due to COVID-era protocols.”

Longer project timelines may be a blessing in disguise for some attractions, though.

“The pandemic has been ideal for planners,” Nelson explains. “Instead of the frenetic, almost too-rushed pace that some developers had been experiencing, this has allowed time for destinations, planners, and suppliers to put appropriate thought into each stage of the process. Shortcuts rarely work and often end up costing more money. The shutdowns have avoided the need for shortcuts.”

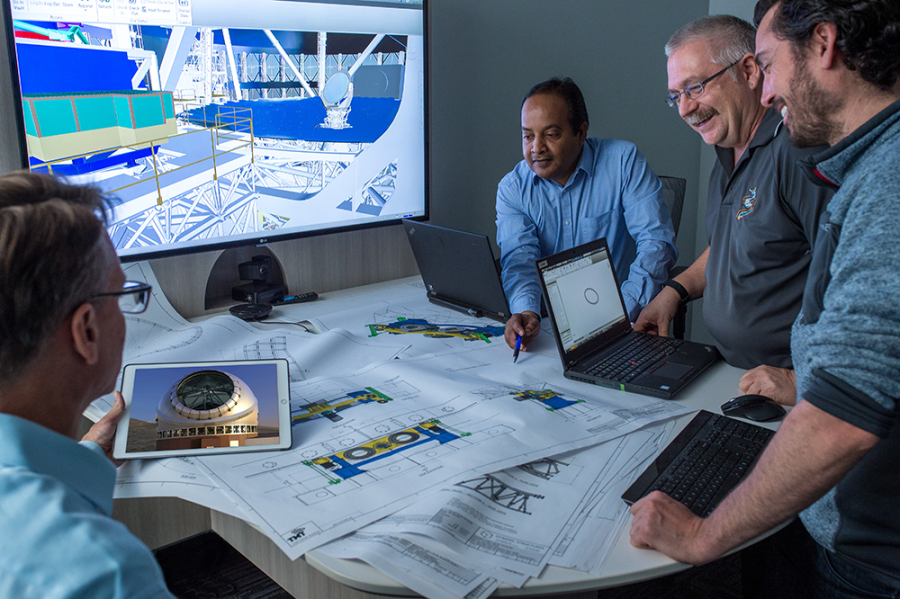

Over the past year and a half, Dynamic has opened several new rides including “SkyFly: Soar America” in Pigeon Forge, Tennessee, United States, “Wings of Destiny” in Doha, Qatar, and large, confidential attractions in China and Japan. Additional rides in France, Malaysia, and the United Arab Emirates are still pending. Dynamic has also taken on more projects outside the attractions industry, including the development of advanced telescopes, while exploring destinations where it can launch its own rides in partnership with an operator.

Nelson notes that Dynamic’s service department has “never been busier,” as it provides audits, analysis, and on-site service to parks.

“Don’t be overly focused on sales if the market has paused; don’t be annoying,” he advises vendors. “However, be very communicative so that you are top of mind when needed.”

Innovations

The challenges of the pandemic have led manufacturers to innovate, both internally and in terms of their offerings.

Christie Digital Systems, for example, which is best known for its projectors, has launched a new line of patented, ultraviolet disinfection fixtures called CounterAct. The first batch of the “far-UVC, mercury-free” lamps that are designed to neutralize pathogens, including COVID-19, is being shipped to customers this month.

“Downtime is the right time to develop and introduce the next level of technology,” says Larry Howard, the company’s senior director of entertainment sales, who adds that Christie has “multiple new projects in development.” Christie, which is a subsidiary of Japan’s Ushio Inc., has also launched several new products over the past year, including “smaller, quieter, and brighter RGB pure laser projectors.”

ProSlide has taken advantage of the downtime to digitize its services and develop new tools to help parks operate more efficiently. From the end of this year and into 2022, ProSlide is rolling out new “enhanced dispatch” and insight systems to its strategic partners to provide actionable insights on ride performance.

There may also be no better time than the present for operators to plan new attractions to entice visitors back to the parks.

“After 40 years in the business, my rule of thumb for new attraction investments is that they cost 50% more to develop and build than the best prepared estimates, and they take several years to achieve 75% of the originally planned revenues,” Needham advises. “However, a good attraction will live for 20 years or more.”