Digital Transactions Hit New Heights

In the contactless economy that has grown during the pandemic, consumers expect instant, seamless, and safe transactions. They want the same convenience when it comes to attractions visits. Digital ticketing and payments can improve the guest experience and create more efficient, cost-effective, and environmentally friendly operations.

Blackpool Pleasure Beach in Blackpool, England, has replaced its wristbands with eTickets. Before visiting, guests download the eTicket to their phones, then scan the eTicket QR code to access the park and rides.

“The main advantage for guests is reduced queue times on entry,” says James Cox, head of marketing for Blackpool Pleasure Beach. “In addition, the eTicket means purchasing and using add-ons, such as Speedy Pass and show tickets, is much easier and can be done through the app.”

Increased security is another benefit. With the eTicket system, all guests must add their name, contact details, and a photograph. “We now know who is on park at all times and have the means to contact them,” Cox says.

The biggest challenge has been educating staff and guests about the eTicket system (which was created in-house). The park has provided staff training and an explainer on its website for guests.

By eliminating paper wristbands and passes, as well as the ink to print them, the eTicket has delivered major savings and provided a greener alternative. “Over one million wristbands and tickets have been replaced by digital versions,” Cox explains.

In Copenhagen, Denmark, Tivoli strives to develop easy-to-use and sustainable ticketing solutions for guests. “We kick off this season with the in-app purchase of ride tickets,” says Chief Commercial Officer Niels Erik Folmann. Wristbands remain for now, but Tivoli aims to “introduce wristbands with a chip to ease our guest journey” later on, he says.

Folmann sees “the digital guest journey as the main contributor to meet our sustainability goals,” but it is still early days.

“In the future, our solutions must cater to basic guest needs (what’s going on, restaurant reservations, off-peak hour visits, etc.),” he says. “Eventually, that will strengthen our capacity planning, cut waste, and enhance the Tivoli experience.”

Cashless is King

Cedar Fair Entertainment Company parks, including Kings Dominion, are going cashless in 2022. “People have been migrating away from cash for a number of years, but COVID accelerated it,” says Bridgette Bywater, vice president and general manager at Kings Dominion and Soak City in Doswell, Virginia, United States.

“With expenses rising, especially in relation to labor, finding efficiencies with our processes makes sense,” she says. Cashless transactions are faster, safer, and more secure. Cashless parks don’t have to pay armored cars to haul currency. “No more time and labor are spent counting cash. Those resources can be redirected toward guest-facing services or operations,” Bywater says.

Guests spend less time waiting in check-out lines and more time at their favorite rides and attractions. And with more time to enjoy themselves, people tend to spend more. “Overall, guests have responded very favorably to going cashless,” Bywater says.

Cedar Fair has partnered with Ready Credit Corporation, a leading provider of payment solutions that support cashless operations, to convert its parks. Kings Dominion accepts credit and debit cards, Apple Pay, and Google Pay. “Ninety-five percent of our guests carry a credit card,” says Bywater; the rest can convert cash to prepaid debit cards at cash-to-card kiosks.

Digital and Mobile First

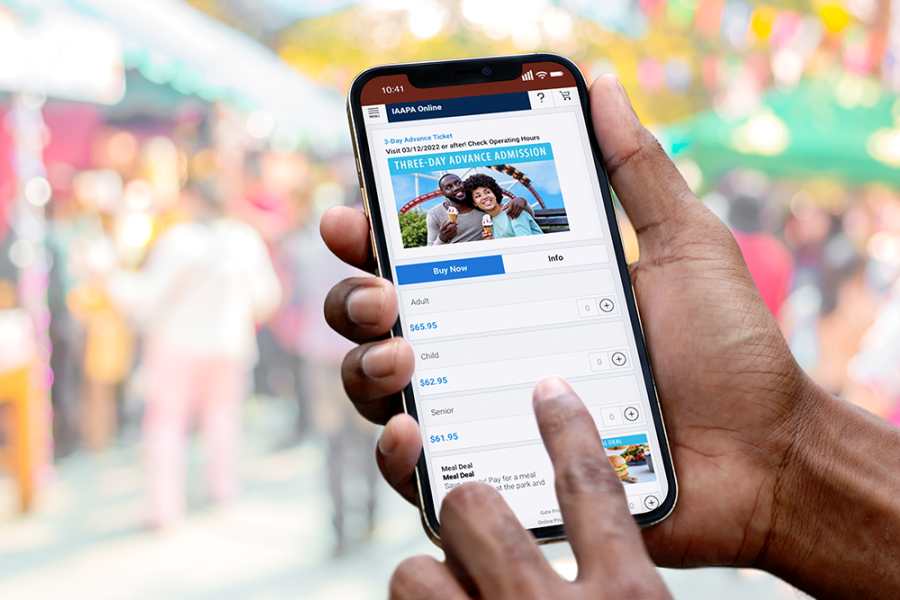

From ticketing to retail, food and beverage (F&B) to virtual queuing, technologies are creating a more convenient and streamlined guest experience. “Mobile is the way to go,” says Michael Wiggins, director of global payments at accesso. Guests are also more willing to self-serve, and “digital allows us to facilitate that,” he adds. For example, parks have transformed F&B operations with mobile food ordering.

Consumers expect personalization, although venues need to strike the right balance with privacy. “Seventy-nine percent of U.S. consumers are concerned about data privacy, but 83% are comfortable sharing their data to get a more personalized and customized experience,” Wiggins says.

Parks! America Inc. is among accesso’s clients taking a digital-only approach, using the accesso Passport ticketing solution. accesso has also announced an extended agreement with Merlin Attractions Operations Ltd., a subsidiary of Merlin Entertainments, to continue delivering accesso Passport across 113 Merlin venues through August 2026, supporting e-commerce and on-site operations.

To help venues accept payments across multiple sales channels, accesso is working with Cybersource, a global, modular payment management platform built on Visa infrastructure. “The consumer will have one identity that bridges the gap between on-site and online, giving them a truly omnichannel experience,” says Wiggins.

Going forward, Wiggins expects to see open banking—including apps like Venmo—change the way people and businesses manage their money.

Fun Powered Digitally

Embed’s customers have achieved breakthroughs after moving away from cash and coins, according to CEO Renee Welsh. One example is Scary Strokes, a family entertainment center (FEC) in Waldorf, Maryland. “As with other businesses, they were hit by the pandemic, but switching to cashless by adopting our Mobile Wallet resulted in 60% normal revenue after their three-month closure. This virtual game card enables guests to reload or top-up from their phone without leaving the game—and when they stay in the zone, it’s a win-win for the operator and their customers,” Welsh says.

Midwest Coin Concepts, a multilocation FEC in the U.S., proved another success story. “Installing our self-service kiosks increased guest credit card usage by 600% in their venues and eliminated labor-intensive service costs from coin or ticket jams,” Welsh says. “Plus, kiosks are a convenient way to upsell promotions to guests. These resulted in an overall 40% increase in their gross year-on-year profit.”

Digital transactions also free up attractions operators to focus on guest service and “making sound, data-driven business decisions, thanks to the smart reporting that digital or cashless solutions produce,” says Welsh.

accesso’s Wiggins believes effective “digital enablement can increase revenue, margins, and engagement,” and Cox of Blackpool Pleasure Beach encourages others considering digital ticketing and payments to go for it.

“It will be a big project, so don’t underestimate or be put off by the change management involved,” Cox says. “You might experience resistance to the shift, but it will be worth it.”